You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying from Europe

- Thread starter NEEpps

- Start date

Odd Man

Thru Hiker

. I'll report beck when it arrives.

For breaking Covid restrictions?

Could get really messy as "rules of origin" are covered in the agreement. If goods originate outside the EU (or UK), then tariffs may apply. Even where the transaction is tariff free, then the wholesaler/reseller/retailer has more paperwork to process which will inevitably lead to higher prices. Such are the 'advantages' of being outside the single market  .

.

Balagan

Thru Hiker

Some selllers just don't understand how VAT works: as an EU customer, I've just received a message from a UK cottage manufacturer (non-hiking stuff) sharing the good news that his prices wouldn't change because he wasn't registered for VAT. He doesn't realise that this, in fact, means his prices will go up 20% and more because he won't be able to deduct UK VAT (since he doesn't collect it in the first place) while I'll pay local VAT and handling charge on arrival...

Last edited:

JamieDIxon

Backpacker

Need some advice, asking for a friend!

He's sourced a Hilleberg Soulo (sorry I know it's not light!) in Denmark but they now don't ship to the UK because of Brexit.

They are now sending it to his family in Germany who will send it on as a gift.

Even though they are sending it as a personal parcel they still need to fill in a customs form.

What value do they need to declare it as to avoid any fees?

I've said 80 euros but after reading this thread think it needs to be lower??

40 euros?50 euros?

Thanks in advance

He's sourced a Hilleberg Soulo (sorry I know it's not light!) in Denmark but they now don't ship to the UK because of Brexit.

They are now sending it to his family in Germany who will send it on as a gift.

Even though they are sending it as a personal parcel they still need to fill in a customs form.

What value do they need to declare it as to avoid any fees?

I've said 80 euros but after reading this thread think it needs to be lower??

40 euros?50 euros?

Thanks in advance

Last edited:

mr_snuffles4

Backpacker

Need some advice, asking for a friend!

He's sourced a Hilleberg Soulo (sorry I know it's not light!) in Denmark but they now don't ship to the UK because of Brexit.

They are now sending it to his family in Germany who will send it on as a gift.

Even though they are sending it as a personal parcel they still need to fill in a customs form.

What value do they need to declare it as to avoid any fees?

I've said 80 euros but after reading this thread think it needs to be lower??

40 euros?50 euros?

Thanks in advance

Are you paying any for it or is it an actual gift, without an exchange of money?

TinTin

Thru Hiker

IME some HMRC VAT inspectors don't really understand.Some selllers just don't understand how VAT works: as an EU customer, I've just received a message from aUK cottage manufacturer (non-hiking stuff) sharing the good news that his prices wouldn't change because he wasn't registered for VAT. He doesn't realise that this, in fact, means his prices will go up 20% and more because he won't be able to deduct UK VAT (since he doesn't collect it in the first place) while I'll pay local VAT and handling charge on arrival...

JamieDIxon

Backpacker

It's a gift so no exchange of money.Are you paying any for it or is it an actual gift, without an exchange of money?

mr_snuffles4

Backpacker

https://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-usersIt's a gift so no exchange of money.

States that gifts up to £39 are are not liable for import VAT.

That should be right, apologies if not.

JamieDIxon

Backpacker

Great, thankshttps://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-users

States that gifts up to £39 are are not liable for import VAT.

That should be right, apologies if not.

TinTin

Thru Hiker

See 2.3 on following page. No VAT and no Duty on purchases up to £135.

https://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-users

https://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-users

Balagan

Thru Hiker

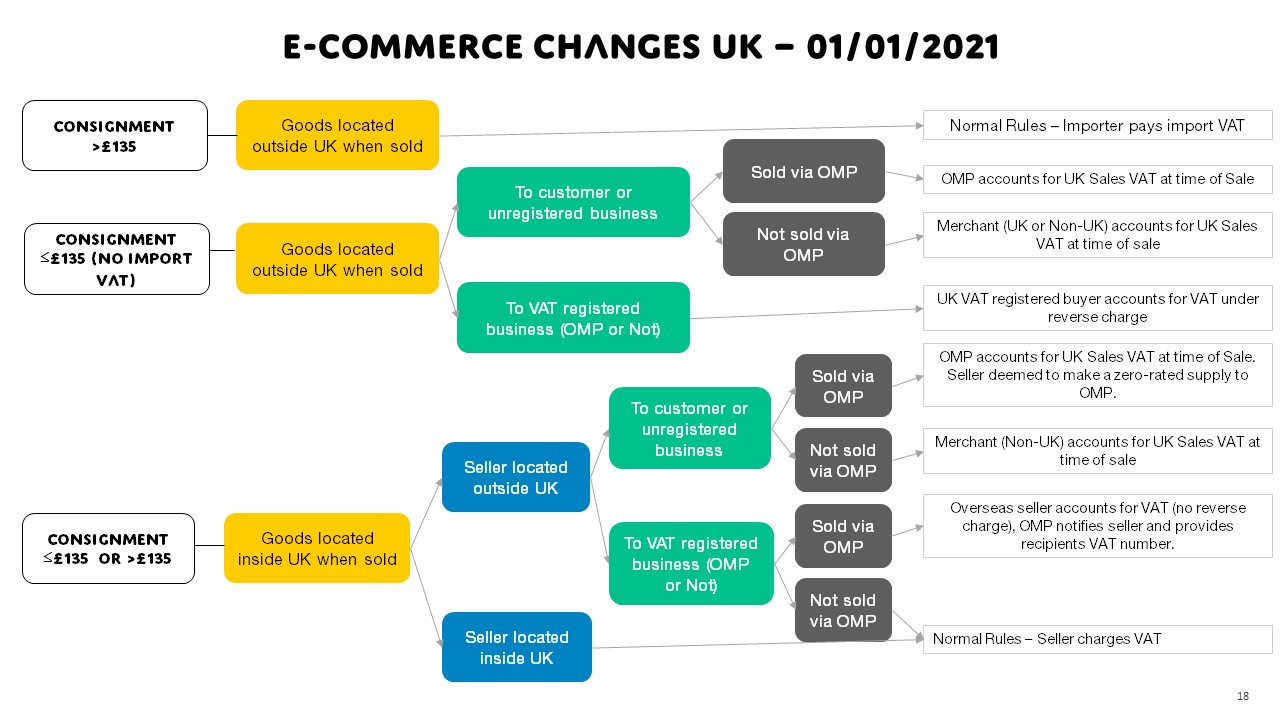

This is only true insofar as it applies to commercial purchases and because, for sales up to £135, it is now mandatory for all foreign-based sellers to collect the VAT on behalf of HMRC. Fine if it is sold on eBay or Amazon because these platform will add the relevant VAT to the transaction, a pain if it is direct sale because it means registering with HMRC even though these sales might be very occasional.See 2.3 on following page. No VAT and no Duty on purchases up to £135.

https://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-users

For gifts, the threshold is indeed £39.

TinTin

Thru Hiker

What do you mean by foreign based?This is only true insofar as it applies to commercial purchases and because, for sales up to £135, it is now mandatory for all foreign-based sellers to collect the VAT on behalf of HMRC. Fine if it is sold on eBay or Amazon because these platform will add the relevant VAT to the transaction, a pain if it is direct sale because it means registering with HMRC even though these sales might be very occasional.

For gifts, the threshold is indeed £39.

JKM

Thru Hiker

What do you mean by foreign based?

All of them....

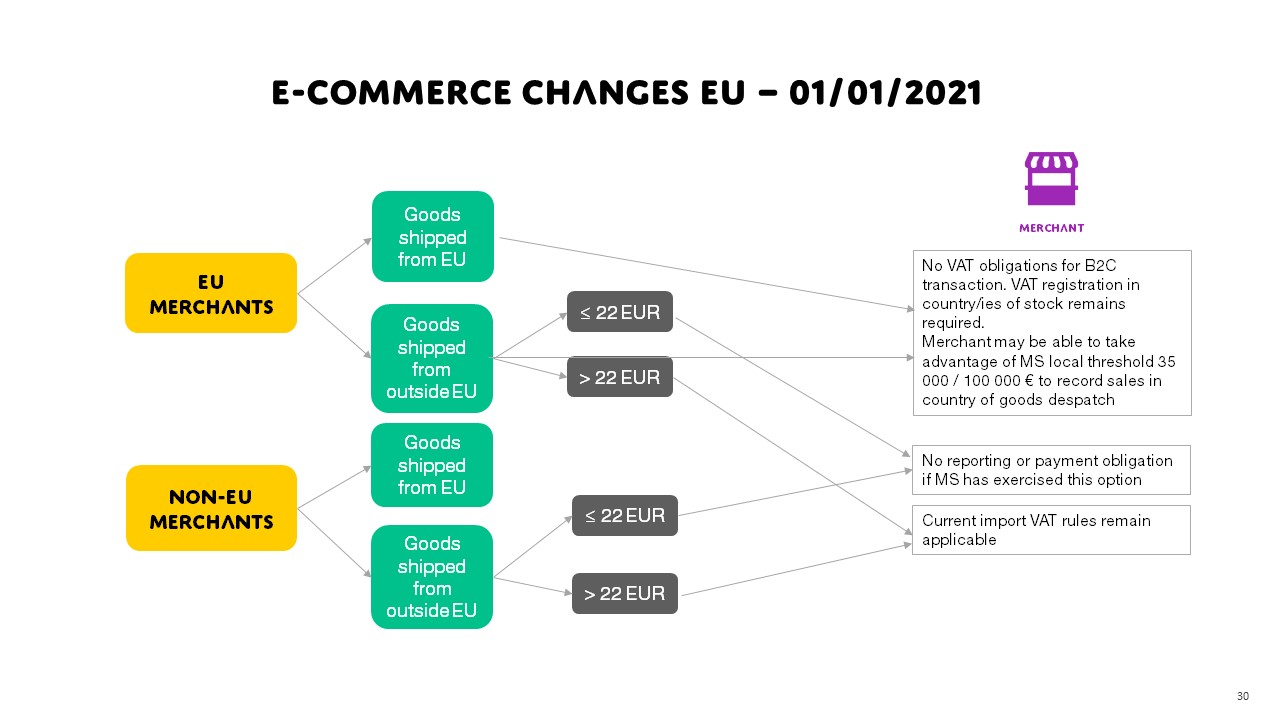

i think we are just getting the current double whammy of Brexit changes and changes that we would have seen in july anyway when they are implemented across the EU

https://ec.europa.eu/taxation_customs/business/vat/modernising-vat-cross-border-ecommerce_en

although obviously these rules now apply to our largest trading partner as well as the rest of the world.

https://www.dutchbikebits.com/shipping

From their website, annoyingly I delayed buying the front carrier and nurses lock I wanted

Britain in 2021

Unfortunately, we will not be able to send parcels to the UK from mid December 2020 onward. Quite apart from uncertainty due to Brexit surrounding the shipping cost, taxation etc. after that time, there is also a problem caused by the British government deciding to impose a unique taxation regime which will require every company in the world in every country in the world outside the UK which exports to the UK to apply and collect British taxes on behalf of the British government. For providing this service they intend to charge a fee to every company in the world in every country in the world which exports to the UK. Clearly this is ludicrous for one country, but imagine if every country in the world had the same idea. If every country decided to behave in the same way then we would have to pay 195 fees every year, keep up with the changes in taxation law for 195 different countries, keep accounts on behalf of 195 different countries and submit payments to 195 tax offices in 195 different countries, and jump through whatever hoops were required to prove that we were doing all of this honestly and without any error.

Therefore from mid December 2020 onward we ship to every country in the world... except the UK.

We have many customers within the UK and would like to be able to trade with them. Not being able to send parcels to the UK does not work in any way in our favour and it is not what we wanted. We are forced by British policy to stop dealing with British customers. If you're angry about this, and you may well be so, please contact your elected representative in the UK.

Balagan

Thru Hiker

Foreign. As in, not from the UK, innit.What do you mean by foreign based?

All sellers, across the world, are supposed to register with HMRC to collect and remit VAT on sales of £135 or less to the UK.

NEEpps

Section Hiker

It seems absurd that any company exporting to the UK with a turnover of more than £85k has to register for VAT. Being self employed I understand some of the intrici's and I certainly wouldn't register if I didn't have to, but flat rate does make it easier.

So if the exporter is not registered for VAT and not using a market place seller the importer is liable for the VAT? I suppose the customs declaration states whether VAT has been paid?

What is the law regarding a refund should you be hit with an unexpected VAT and handling charge bill?

So if the exporter is not registered for VAT and not using a market place seller the importer is liable for the VAT? I suppose the customs declaration states whether VAT has been paid?

What is the law regarding a refund should you be hit with an unexpected VAT and handling charge bill?

TinTin

Thru Hiker

So what you are saying is that, for example, if Mountain Laurel Designs want to sell to the UK market they have to register for UK VAT and charge UK VAT on things that they sell here. That is just bizarre and not going to happen. I can understand that for the EU where up to this point VAT has been charged based on the place where the things are before they are exported, Cumulus - Poland etc, shifting to charging the VAT of the country they are being exported to and there needing to be some mechanism for that to work but I can't see US or Chinese companies, for example, doing it.

Surely it must only be the EU.

Surely it must only be the EU.

Charlie83

Thru Hiker

So what you are saying is that, for example, if Mountain Laurel Designs want to sell to the UK market they have to register for UK VAT and charge UK VAT on things that they sell here. That is just bizarre and not going to happen. I can understand that for the EU where up to this point VAT has been charged based on the place where the things are before they are exported, Cumulus - Poland etc, shifting to charging the VAT of the country they are being exported to and there needing to be some mechanism for that to work but I can't see US or Chinese companies, for example, doing it.

Surely it must only be the EU.

Don't know if it's the same thing, But something to watch for on ebay

Two nights ago I got an offer from a seller on ebay when I was on the ebay app, (just a £5 piece of plastic I needed for a project). Turns out it's through Ali or some similar Chinese sellers I think.

The price was £4.99

The offer was £4.69

Actual price paid was £5.63 as they added 20% VAT

On the Ebay app, when you accept the offer you (or I didn't anyway) dont see the added vat, you think your getting the offer price until you've committed to buy.

Annoying but not bank breaking, be a different story with something of higher value (not that I expect to ever spend more than a fiver for anything from Ali

TinTin

Thru Hiker

I wonder if Ebay collect the VAT for HMRC. It would make sense for enabler markets like Ebay to provide that service.Don't know if it's the same thing, But something to watch for on ebay

Two nights ago I got an offer from a seller on ebay when I was on the ebay app, (just a £5 piece of plastic I needed for a project). Turns out it's through Ali or some similar Chinese sellers I think.

The price was £4.99

The offer was £4.69

Actual price paid was £5.63 as they added 20% VAT

On the Ebay app, when you accept the offer you (or I didn't anyway) dont see the added vat, you think your getting the offer price until you've committed to buy.

Annoying but not bank breaking, be a different story with something of higher value (not that I expect to ever spend more than a fiver for anything from Ali)

Only thing is that particular transaction doesn't fit the rules as it should be VAT and duty free.

Balagan

Thru Hiker

Just you watch.So what you are saying is that, for example, if Mountain Laurel Designs want to sell to the UK market they have to register for UK VAT and charge UK VAT on things that they sell here. That is just bizarre and not going to happen. I can understand that for the EU where up to this point VAT has been charged based on the place where the things are before they are exported, Cumulus - Poland etc, shifting to charging the VAT of the country they are being exported to and there needing to be some mechanism for that to work but I can't see US or Chinese companies, for example, doing it.

Surely it must only be the EU.

I have a friend who runs a small business in Singapore making expensive short-run products mostly sold through Kickstarter. He's just been told he has to register with HMRC as Kickstarter doesn't plan to act as an agent unlike eBay, Amazon and Aliexpress. So no, not just EU.

His options: sell on eBay or Amazon and forego crowdfunding, label his packages as "gift" and run the risk of his customers being hit with VAT, handling charge and a fine (because importers are responsible for customs declarations) or just say s*d it, the real money is in Japan, the US and the EU in this order. Guess what he chose...

Last edited:

Heltrekker

Section Hiker

Unfortunately, it works both ways

From the UOG site -

"Brexit 1st January 2021

Thank you to our valued customers in the EU for your continued support.

For EU orders placed from 1st January 2021, we will no longer charge UK VAT (sales tax). You will be charged your local sales tax on entry to your country and could be charged duty on products manufactured outside the EU and UK."

From the Montane site -

"Following the EU-UK Trade and Cooperation Agreement significant changes have been made to the way we ship your parcels across the EU boarder.

Due to unprecedented circumstances our courier DPD is currently pausing and reviewing the EU delivery service until Tuesday 12th January to ensure they have the correct shipping information for your order to enter the EU.

This will impact delivery of orders which have been placed up to the 6th January and pause the fulfilment of orders placed on the 6th of January onwards until 12th January 2021.

We apologise for any inconvenience caused."

From Rock + Run

"EUROPE - SUSPENDED DELIVERIES

We have temporarily suspended all our shipping options to Europe.

A combination of new Brexit regulations and COVID-19 has caused massive delays to international shipments and our couriers have suspended European deliveries.

We will keep this page updated with any changes and with alternative shipping solutions when they are available.

If you have any questions regarding orders already in transit, please contact us info@rockrun.co.uk"

Rather than get stung, for the time being and until various customs and tax offices sort out their , I won't be buying from the UK as the confusion seems to be both sides of the channel

, I won't be buying from the UK as the confusion seems to be both sides of the channel

From the UOG site -

"Brexit 1st January 2021

Thank you to our valued customers in the EU for your continued support.

For EU orders placed from 1st January 2021, we will no longer charge UK VAT (sales tax). You will be charged your local sales tax on entry to your country and could be charged duty on products manufactured outside the EU and UK."

From the Montane site -

"Following the EU-UK Trade and Cooperation Agreement significant changes have been made to the way we ship your parcels across the EU boarder.

Due to unprecedented circumstances our courier DPD is currently pausing and reviewing the EU delivery service until Tuesday 12th January to ensure they have the correct shipping information for your order to enter the EU.

This will impact delivery of orders which have been placed up to the 6th January and pause the fulfilment of orders placed on the 6th of January onwards until 12th January 2021.

We apologise for any inconvenience caused."

From Rock + Run

"EUROPE - SUSPENDED DELIVERIES

We have temporarily suspended all our shipping options to Europe.

A combination of new Brexit regulations and COVID-19 has caused massive delays to international shipments and our couriers have suspended European deliveries.

We will keep this page updated with any changes and with alternative shipping solutions when they are available.

If you have any questions regarding orders already in transit, please contact us info@rockrun.co.uk"

Rather than get stung, for the time being and until various customs and tax offices sort out their

, I won't be buying from the UK as the confusion seems to be both sides of the channel

, I won't be buying from the UK as the confusion seems to be both sides of the channel Bmblbzzz

Thru Hiker

Unfortunately, I think you're right. And obviously the more niche or low-volume the product, the greater the hassle:value ratio of all the paperwork for the relatively small market.I think it will only incentivise them to deal with a smaller range of brands rather than a larger.

In the long run there will be much less choice.

Surely the customs union also means there is no duty? Once outside of that, there is duty; we're not noticing that because the duty agreed between UK and EU has been set at "nothing" – at least for imports of finished goods like this.I think many conflated a trade deal with the customs union. The former controls duty and quotas and the latter the import vat. A trade deal was never going to make a difference to joe public.

In any case, hopefully the actual course of registration etc will become clearer in a month or two.

JKM

Thru Hiker

Surely the customs union also means there is no duty? Once outside of that, there is duty; we're not noticing that because the duty agreed between UK and EU has been set at "nothing" – at least for imports of finished goods like this.

.

I'm not up to date on it but I think that the rules on 'county of origin' have an impact on this.

https://ec.europa.eu/taxation_customs/business/calculation-customs-duties/rules-origin_en#:~:text=Rules of origin determine where,of goods traded in commerce.

"Rules of origin determine where goods originate, i.e. not where they have been shipped from, but where they have been produced or manufactured. As such, the ‘origin’ is the 'economic nationality' of goods traded in commerce."